Ratnaafin

Bridging the Gap

to Financial Freedom

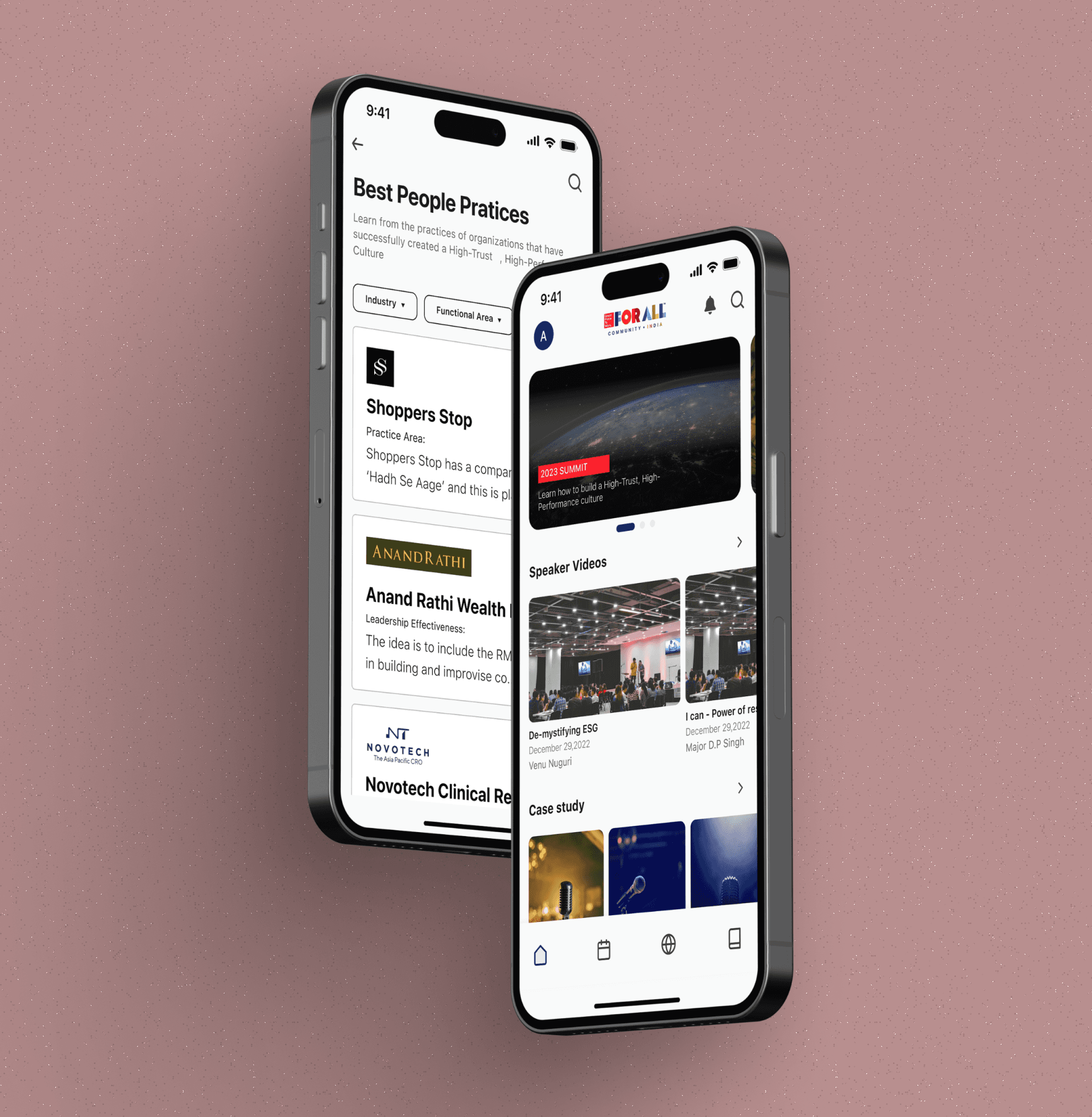

Design to digital

UI/UX

Fintech

Company

Hedweeg Innovation Pvt Ltd

role

UI Designer

TIMELINE

9 months

Year

2022

Tools

ABOUT Project

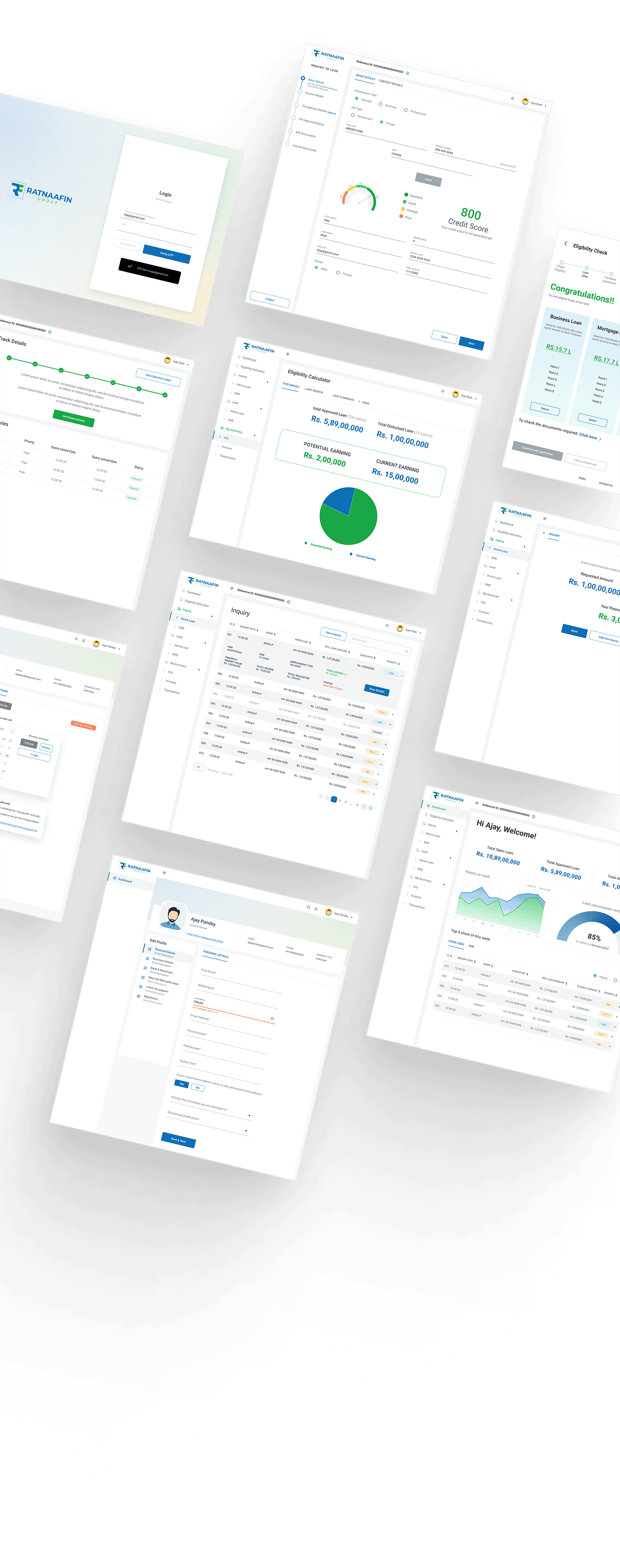

"Transforming a legacy financial service into a modern, user-friendly digital platform for greater customer engagement and operational efficiency."

Ratnaafin’s traditional, agreement-heavy and paper-based processes made it difficult to serve busy customers and engage with end users. With a B2B-centric model and outdated systems, the company struggled to provide convenient, intuitive digital solutions. This project focused on reimagining the customer experience by streamlining operations, modernizing the interface, and shifting toward a more accessible and scalable digital ecosystem, enabling both growth and improved user satisfaction.

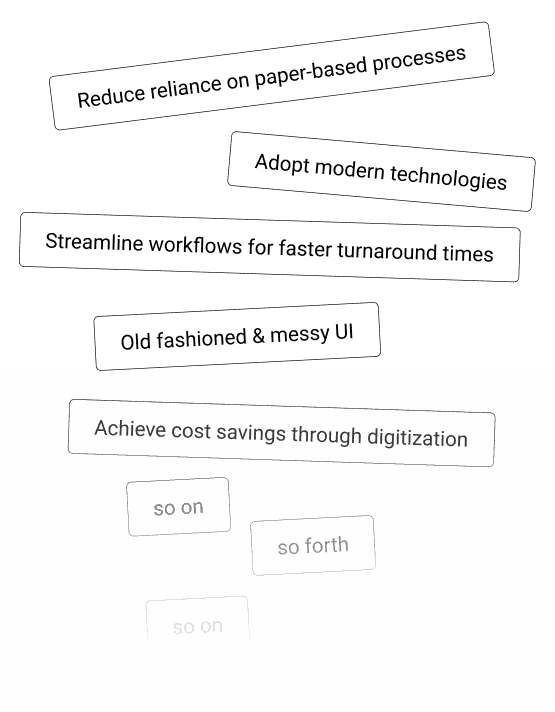

Main Triggers - [Problems]

Ratnaafin’s outdated processes and B2B focus led to a lack of user-friendly digital solutions for busy customers, hindering engagement and growth potential.

A digital transformation was required to create a streamlined platform with a simple tone of voice that enhances user experience and increases customer engagement.

Ratnaafin’s old-school approach and B2B focus presented significant challenges in meeting the needs of its customers, particularly busy individuals who require user-friendly and efficient financial services

With a lack of modern digital solutions and a focus on verbal agreements and paper-based processes, the company faced difficulties in engaging with end consumers and expanding its customer base. This, in turn, limited its growth potential and competitive edge in the market.

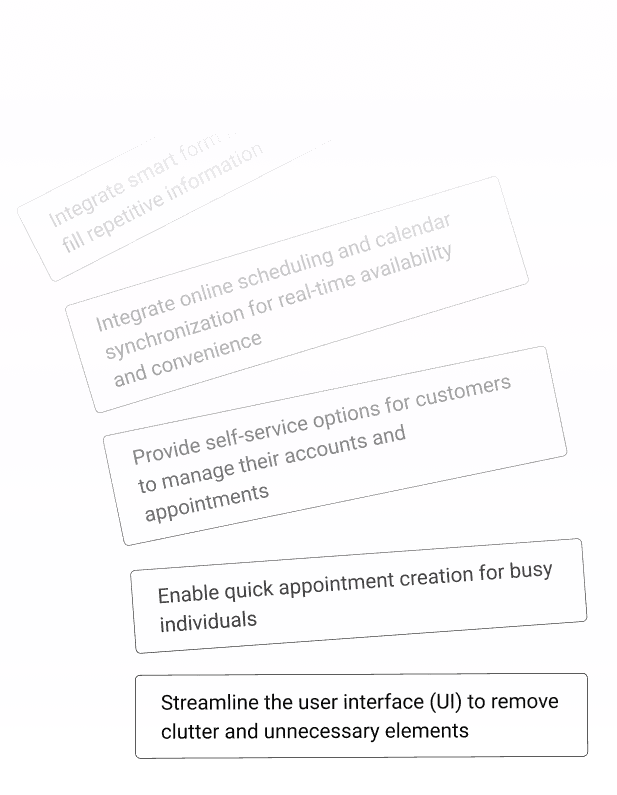

Taking care of users - [Solutions]

We proactively addressed every problem identified during the process by providing modern, innovative, and seamlessly compatible solutions, ensuring a comprehensive and effective resolution to enhance the user experience.

Our primary goal in terms of UI was to create a user-friendly experience that fosters comfort and provides extensive assistance, all while incorporating UI concepts and adopting a human-centric approach to ensure optimal user engagement and satisfaction.

01

Tagline

Empathize

Understand the needs and pain points of Ratnaafin's customers through user research and feedback.

02

Tagline

Define

Analyze and synthesize the data gathered in the Empathize stage to define the problem statement and identify the key areas for improvement

03

Tagline

Ideate

Brainstorm and generate ideas for potential solutions to address the defined problem statement and improve customer experience

04

Tagline

Prototype

Create a tangible and testable prototype of the solution, using digital tools to create a user interface and experience that aligns with Ratnaafin's goals and values.

05

Tagline

Test

Test the prototype with real users and collect feedback to evaluate its effectiveness and identify areas for improvement.

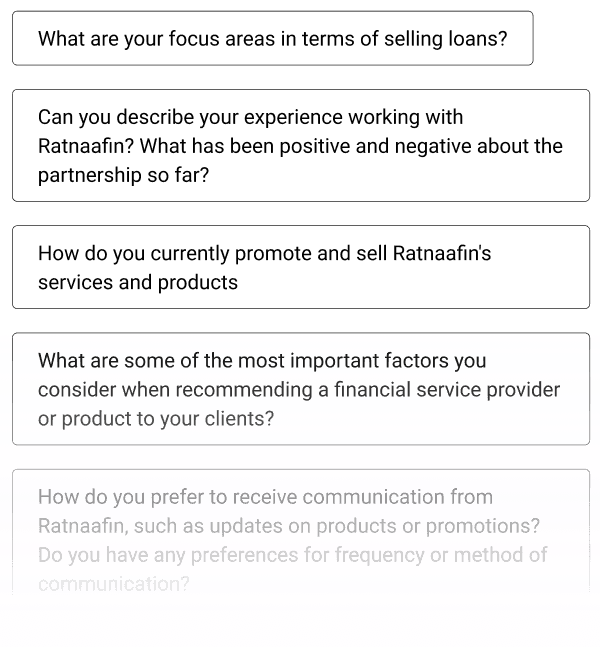

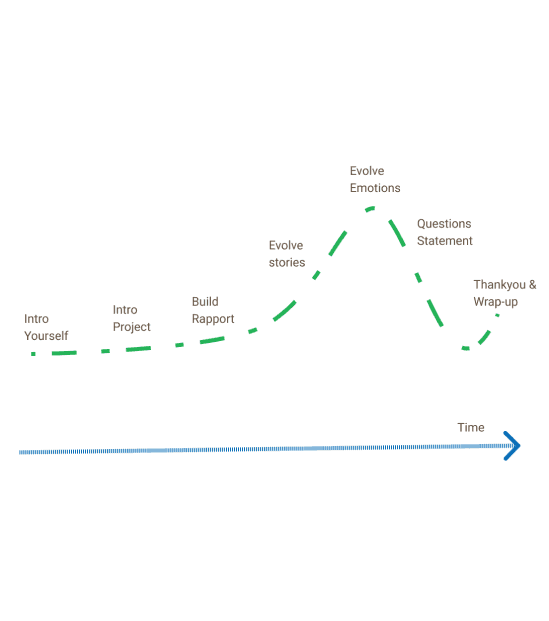

Getting to know users -

[Empathic conversation]

Taking care of users - [Solutions]

We proactively addressed every problem identified during the process by providing modern, innovative, and seamlessly compatible solutions, ensuring a comprehensive and effective resolution to enhance the user experience.

Our primary goal in terms of UI was to create a user-friendly experience that fosters comfort and provides extensive assistance, all while incorporating UI concepts and adopting a human-centric approach to ensure optimal user engagement and satisfaction.

Target Audience

[Persona]

Ravi Mehta

Focused on

Home Loan Acquisition for middle-income families

Monthly Loan Volume

₹3-4 Lakhs per month

Preferred Banks/NBFCs

Major national banks and housing finance companies

What matters to me

✦ He prioritizes a smooth and hassle-free documentation process.

✦ Prefers lenders who offer competitive interest rates and transparent fee structures.

✦ Values personalized customer service that guides his clients through every step of the loan process.

I need help here

✦ Struggles with the high number of document requirements from traditional banks.

✦ Encounter delays in the loan disbursement process due to stringent verification procedures.

✦ Often deals with inconsistent communication from relationship managers, causing client frustration.

Neha Sharma

Focused on

Small Business Loan for Startups

Monthly Loan Volume

₹1-2 Cr per month

Preferred Banks/NBFCs

Local cooperative banks and microfinance institutions

What matters to me

✦ She values quick loan approvals to support urgent funding needs for startups.

✦ Looks for flexible repayment options that cater to the unpredictable cash flow of new businesses.

✦ Prefers lenders who understand the unique challenges faced by startups and offer tailored solutions.

I need help here

✦ Faces challenges with lengthy approval processes that do not align with the fast-paced startup environment.

✦ Experiences difficulty in obtaining loans for clients without substantial collateral.

✦ Needs better support from banks in terms of mentoring and financial advice for her startup clients.

Vikram Singh

Focused on

Agricultural Loans for Rural Farmers

Monthly Loan Volume

₹2-3 Cr per month

Preferred Banks/NBFCs

Government banks and rural-focused financial institutions

What matters to me

✦ He prioritizes lenders who offer subsidized interest rates under government schemes.

✦ Values simple and accessible loan application processes, given the rural clientele.

✦ Prefers banks that provide additional services like crop insurance and farm equipment financing.

I need help here

✦ Struggles with the cumbersome documentation requirements, which are often challenging for his rural clients.

✦ Faces delays in loan processing, especially during peak farming seasons.

✦ Encounters issues with the transparency of loan terms and conditions, leading to distrust among clients.

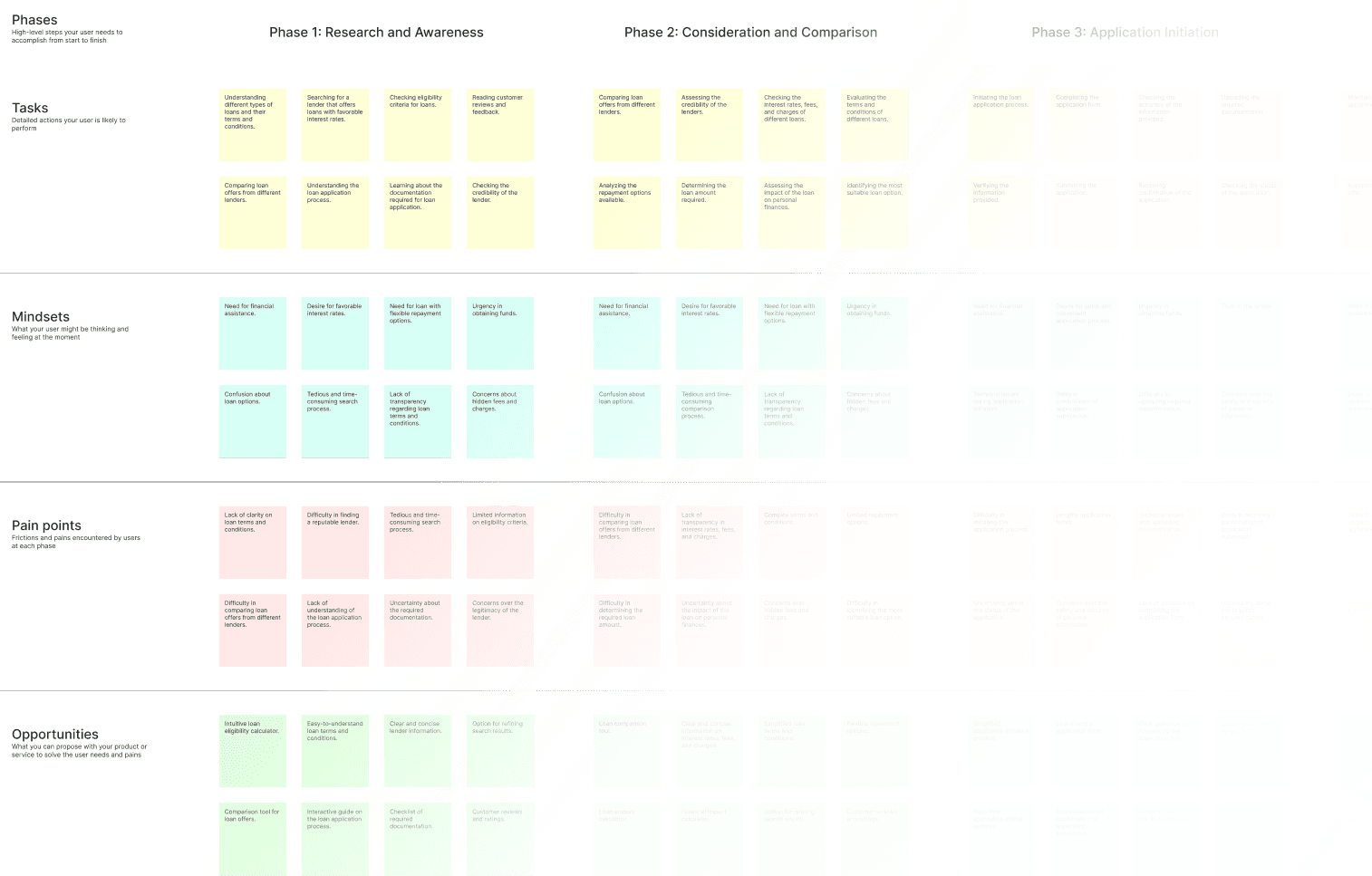

Know our customers more - [Journey Mapping]

We've mapped out the steps you have to go through to get a loan. We've highlighted both key areas that make the process easier as well as those that may negatively impact your user experience

Credits

Services

Digital Design

Creative development

Ecommerce

CMS integration

API integration

Tools

Framer

Airtable

Vercel

SendGrid